You don’t need to be an insurance nerd to make a smart choice. All you need is to know how term vs whole life insurance fits real family budgets, timelines, and goals. This guide gives you the cost, duration of coverage, cash value, riders, conversion windows, and common traps of both types of policies. Plus, it gives you copy-paste shopping steps so that you can make your choice with confidence this week.

The Quick Answer (So You Can Breathe) ✅

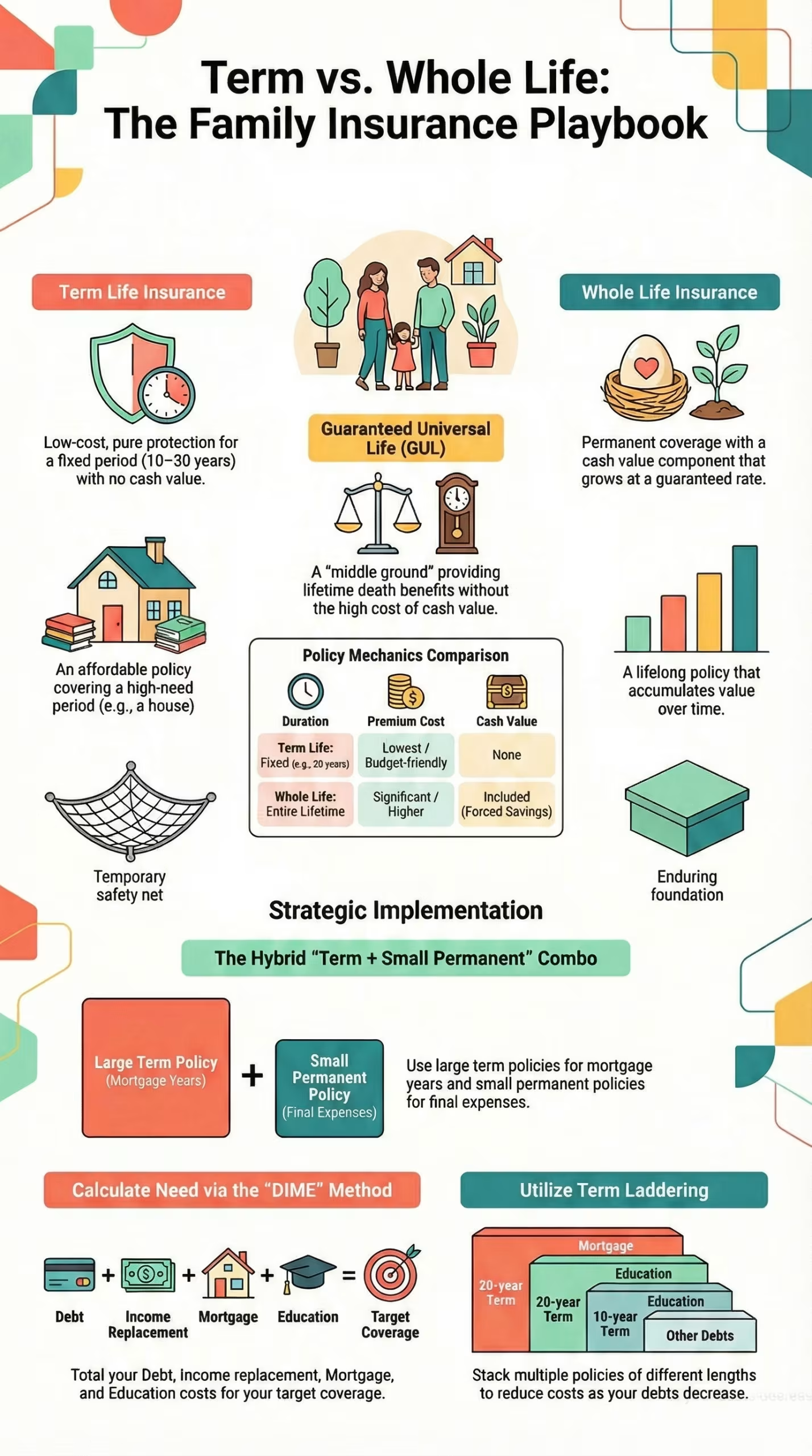

Most families who are trying to protect their income while raising children or paying the mortgage are best served by cheap term life insurance (20 to 30 years) for a large face value.

Buying whole life insurance makes sense if your situation demands permanent life insurance coverage. These needs include having dependents who will require funds for their life or special needs planning, or meriting final expenses guarantees. You may also buy the policy if you have specially-valued guarantees. The policy can also work out well if you want a disciplined forced-saver as an investment, and your finances can comfortably accommodate whole life premiums.

If you are looking for a death benefit that lasts forever without a heavy focus on cash value–Guaranteed Universal Life (GUL) is likely to be cheaper than whole life for “coverage-for-life” goals.

Stuck? Employ a term + small permanent combo: big term for the high-need years, small whole life/GUL for forever coverage.

How Life Insurance Actually Works (In Clear Terms) 🧩

All life insurance contracts exchange premiums for a death benefit which is tax-free for your beneficiaries. The differences.

Term life is a pure insurance policy for a fixed term (10–40 years) No cash value. The policy pays if you die in the term, but if you die after the end of the term, the policy ends (or you can often convert to permanent within a window).

Whole life: Keeps you covered for the whole of your life, provided premiums are paid. Fifty-three per cent of each premium goes to the cash values, which are guaranteed to grow and also pay dividends if ‘participating’. You can take out a loan against the cash value or choose to cash in your policy (fees may apply).

Term Life, De-Mystified 🧭

Why Families Love It

- Lowest cost per dollar of coverage lets you purchase the amount you really need (often 10-20x income, or via DIME: Debt + Income replacement + Mortgage + Education).

- Simple to understand, easy to compare.

Key Choices

- The duration of 20-30 years generally covers kid-raising and mortgage years.

- A level premium means that the premium is fixed and remains the same throughout the entire term of the insurance policy.

- You can often convert a term policy you have (without a new medical exam) to a permanent one if you need to do this due to health change.

- You can renew your insurance policy annually after its term (which is generally very costly) or shop for other policies.

Common Riders

- An accelerated death benefit allows access to part of your benefit if you are terminally ill.

- The policy will not lapse if you become disabled.

- Child rider (small coverage for children).

- Return of premium has a higher cost and if you outlive the term, you will get your base premiums back. That’s nice but it’s not always efficient.

Whole Life, De-Mystified 🧭

What You’re Buying

You get insurance coverage for life plus a cash value that builds at a guaranteed rate that you can be assured of. The participating policy may declare dividends but that is not guaranteed.

Premiums for permanent insurance type is costlier than term for equivalent death benefit.

Why Some Families Consider It

- Continual need (lifetime dependence, property or last cost arranging).

- Stable and guaranteed growth in cash value and a don’t-have-to-think-about-it forced savings.

- Access to policy loans (borrow against cash value). If you don’t pay the loan back, including interest, it will reduce your death benefit.

Watch-Outs

- You will face surrender charges in the early years. The cash value builds slowly at first.

- If you fail to pay and do not use nonforfeiture options, the policy may lapse.

- High premiums may limit contributions to retirement or emergency fund due to opportunity cost.

Cost Reality Check (Illustrative Ranges) 💵

Your actual rates will depend on your age, health class, the level of coverage, and state. These rough ranges are for non-smokers in good health.

Cost of Term and Whole Life Insurance in Canada

If you want to have the maximum protection during your high-need years, then term allows you to purchase the right amount without crushing your budget.

When Whole Life (Or GUL) Can Make Sense 🌲

- Always needing help (special-needs plan; trust fund).

- A guaranteed universal life insurance policy provides your loved ones with a permanent death benefit that is unaffected by age or market cycles. GUL generally provides coverage for the rest of your life, is less expensive than whole life, and has a smaller or no cash value.

- You prefer saving money that is impossible to spend or lose.

- One way to remove later uncertainty for adult children is with a small permanent policy earmarked for burial/legacy.

An Effective Compromise: Building Complementing Protection

Big term with small permanent means a million-dollar term for 25 years which will take care of the kid years or mortgage years. Then also include between 25 and 50 thousand whole life or GUL for the final expenses or legacy.

Term laddering refers to spacing out multiple term policies of different lengths (10/20/30) to reflect decreasing needs as debts drop and kids launch.

This makes things affordable now while making everything certain forever.

How Much Coverage Do Most Families Need? 📏

Three fast approaches.

- The income multiple will be 10-20x per annum (if you want tuition + mortgage fully covered, go closer to 20x).

- DIME is an acronym for Debts + Income replacement (years of cover) + Mortgage + Education.

- Budget-based: Measurable monthly outgoings (housing, childcare, healthcare, food, transport) × decades + final expenses + debts.

It's a good idea to think of amounts that will allow the other spouse to keep the family home, maintain the kids’ routine and allow time to make cool-headed decisions like selling.

Cash Value: What It Is Not? 🏦

It is the cash value that pays whole life insurance. It grows at a guaranteed rate. Further, you can take a loan against the cash value.

The insurer's general account backs it, so growth is slow but steady.

Isn’t.

A magic high return. Early cash value is slow due to fees and commissions.

That could be a good stand-in for an emergency fund, or for retirement (after 401(k)/IRA basics).

Loans & Taxes (High Level)

- The Policy loan is not taxable on the date of the loan; however, they do lower the death benefit. Further, if unmanaged they can trigger the collapse of the policy.

- Surrenders may create taxable gains if cash value > basis.

- The Modified Endowment Contract (MEC) rules affect the tax treatment of a life insurance policy if the funding is too heavy or too fast. If your plans are to overfund a policy, ask the agent to run those tests.

Riders Worth Knowing (And What They Do) 🧰

- Accelerated Death Benefit: withdraw part of benefit if terminally ill.

- Waiver of Premium meaning: the premiums will be waived if you become totally disabled as definition states.

- Child Rider is an option to get a child policy.

- “During the years you need the coverage the most, the term rider provides coverage at low rates.”

- Chronic or critical illness riders allow borrowers to advance part of the benefit if they meet certain conditions (triggers).

Underwriting Tips To Lower Your Rate 🩺

- Make sure to apply before the birthday that pushes you into the next rate bucket.

- Choose Optimal Labs: Drink Water; Avoid Excessive Salts or Alcohol 24-48H; Prefer Morning Exam

- Be prepared with medical records, list your prescriptions, conditions, and physician contact information.

- Tobacco and vaping contain chemicals that you should disclose to your dentist.

- Look at different top insurers since they all have different underwriting tastes so one carrier may price your profile better than the others.

Step-By-Step Shopping Plan (Copy This) 🛒

- Determine the purpose of insurance for income replacement or other needs.

- Pick structure.

- Most families take a 20–30-yr level term for the big need.

- Add small permanent if you want lifetime coverage.

- Verify features: expiry conversion window, strong riders you value.

- Don’t accept the cheapest quote; ensure your policy has your preferred benefits.

- List down the beneficiaries and consider a trust if needed.

- Set up autopay; review annually (new-baby, pay rise, debt).

- Don’t replace existing cover until a new policy is in force.

Alternate Permanent Options (Know The Landscape) 🗺️

Thus a guaranteed lifetime death benefit for the insured is focus of guaranteed universal life (GUL) with minimal cash value so it often costs less than whole life. If all you want is just keep me covered forever insurance, this is it.

IULs attach the cash value crediting to an index and have caps and floors. They also have a complexity risk. So, it’s important to be clear regarding the policy expenses and illustrated returns vs reality.

VUL is an insurance product with investment subaccounts that links market risk to policy charges.

GUL or whole life is generally simpler than IUL/VUL if you’d rather not watch a policy.

Common Mistakes (And Easy Fixes) 🧯

- Buying less coverage as whole life premiums consumed the budget.

- First, buy enough-term insurance. Then, add permanent if you want.

- Ignoring conversion windows on term.

- Make a note on the calendar about the deadline. If health permits, follow through with partial conversion.

- Letting a policy lapse after years of paying.

- Before giving up a policy, ask about reduced paid-up or extended term options.

- Naming only one beneficiary.

- Update your Will regularly to add contingent beneficiaries

- Confusing illustrations with guarantees.

- Fix: Look at the guaranteed column and ask the agent to define the assumptions made.

Tips, Tricks, Hacks & Local Secrets 🧠

- Pick a term with smart conversion privileges attached to it, so you can keep your options open should your health change.

- Taking out a policy laddering of a 1M 10-yr + 750k 20-yr + 500k 30-yr can potentially cost far less than a single 30-yr 1M. By being thorough, you can also achieve a better coverage for your declining need through this method.

- GUL for life: If you are only looking for a guaranteed death benefit for life, compare GUL vs whole life premiums side by side↑.

- Consider using return-of-premium if you hate “use it or lose it.” It gives a nice confidence boost, but compare the IRR vs simply investing the difference.

- Check a beneficiary's hygiene after marriage, divorce, birth, new house or new business.

- Portable protection for stay-at-home parents: their work has replacement cost (childcare, household)—cover them, too.

- If you take a loan from whole life, a premium payment plan must be set up, and unpaid interest can eat the whole policy.

FAQs — Term Vs Whole Life For Most Families ❓

What’s the major difference between term and whole life insurance?

When does whole life make sense for a typical family?

What is a term conversion option, and why should I care?

How much insurance do most households need—10× income or more?

Can I mix term and whole life in one plan?

Are the payouts taxable to the beneficiary?

What’s the difference between whole life and GUL for permanent coverage?

Do policy loans from whole life trigger taxes?

How can I avoid a policy lapse after paying whole life for years?

Should stay-at-home parents have life insurance?

Can we get life insurance when both partners have a chronic illness?

Does vaping count as smoking for life insurance rates?

Is supplementary (group) life insurance enough?

Will the premium of a term plan go up every year?

Can I start with term and later add a small whole life policy?

Is whole life a good college savings plan?

How do I name beneficiaries correctly and what if my agent pushes whole life when I want term?

Final Thoughts 💬

Most families will find that a large, inexpensive term policy that covers the years when your income and presence count most—and a small permanent policy for peace of mind for the rest of your life (if you so choose)—is the best bet. Choose coverage options wisely, lock in features, and select simple policies.

The goal shouldn’t be the fanciest product, but rather the right amount kept in force.

Comments (0)

No comments yet. Be the first to share your thoughts!

Leave a Comment