Picture this: Payday is every other Friday but the bills show up out of the blue and by Tuesday you’re thinking “where did that check go?You don’t have to have a math degree to handle your own money–you just need a biweekly budgeting (and spending) method to transform each paycheck into an easy-to-use, repeatable plan.

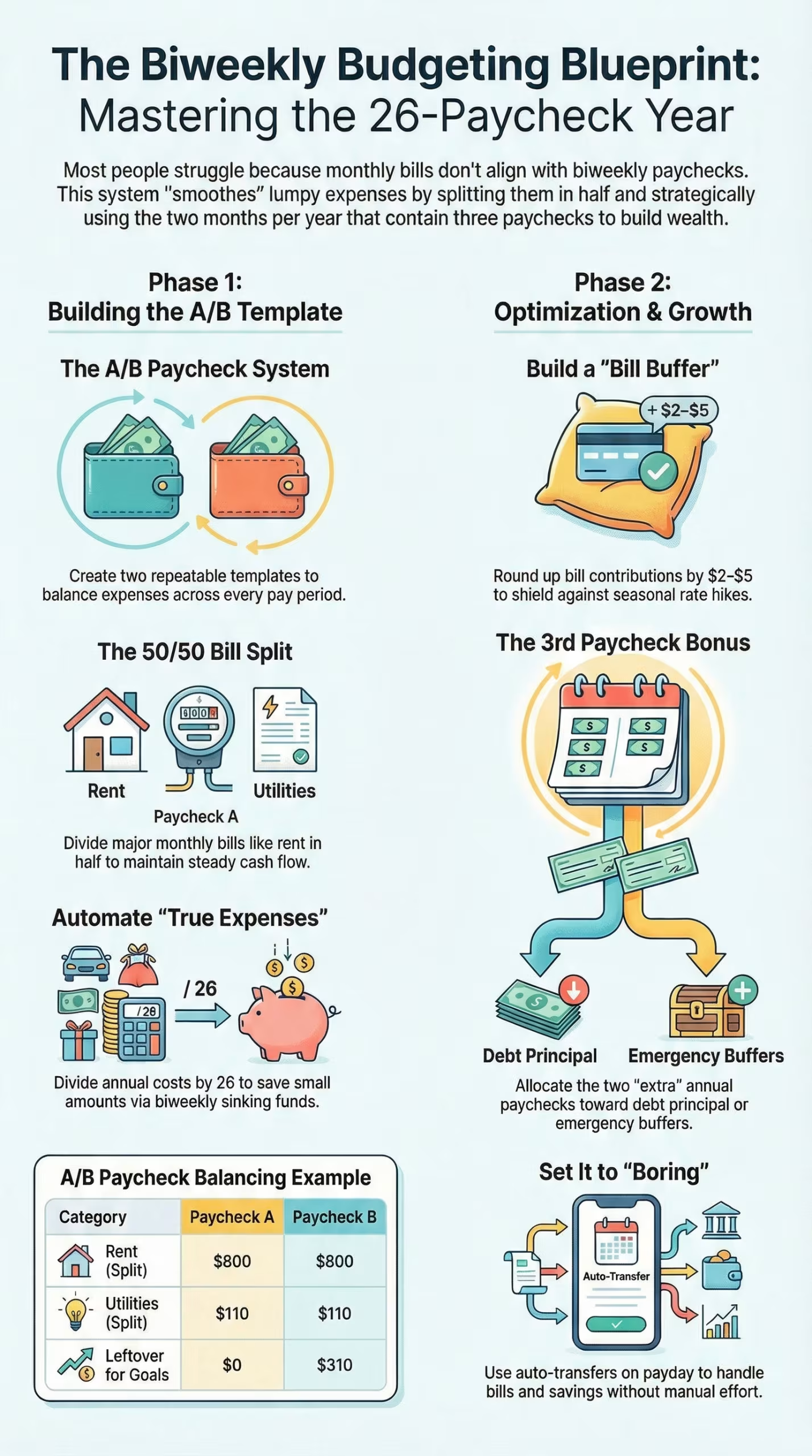

By using this friendly guide, molding “lumpy” bills into smooth biweekly amounts, and making the most of your magical 3-paycheck months, you’ll finally get ahead with your paycheck budget template! No gimmicks. No overwhelm. It’s just a simple system you can duplicate—paycheck after paycheck—so your cash flow experience gets boring in the best way possible.

Why Using a Budget Biweekly is Effective (When Using One Monthly Isn’t) 🧩

Your bills and income should ideally start coming on the first of the month for monthly budgets. Real life rarely listens. Most workers get 26 paychecks per year. But, because of leap year, there are two months a year that offer you 3 paychecks. That rhythm matters.

- You match payments to payday instead of due date juggling.

- You split large monthly expenses into two smaller payments (e.g., half the rent from each pay).

- You plan on those three paycheck month’s money intentionally (debt paydown, sinking funds or true emergency buffer).

- It helps bring down stress, stops the overdrafts, and cash flow finally makes sense.

Step 1: Plan Out Your Paydays for the Next 12 Months. 🗓️

Open your calendar and mark every payday for the next year. Identify the two months in which you receive 3 paychecks Now you can build two repeatable templates.

- Payment A: A paycheck that comes in the first month.

- Check B is the second check of a typical month.

Each template will be loaded with specific bills and saving actions so that you’re never guessing on payday.

Step 2: List Your Bills and Convert to Biweekly Amounts

Make a list of fixed monthly bills including rent/mortgage, utilities, phone, internet, insurance, car payment and subscription. For each, calculate a biweekly contribution.

- Rent $1,600 → $800 from each paycheck.

- Internet $70 → $35 each paycheck.

- Car Insurance $120 → $60 each paycheck.

A savvy way to buffer your bill account is to collect a few extra dollars on each contribution. If they contribute $35, for instance, round it up to $38. Those little round-ups quietly shield you from seasonal rate hikes.

Step 3: Create Templates for Your Paycheck A/B Testing

Make two columns entitled “Paycheck A” and “Paycheck B.” Further, make a category for each paycheck.

- Paycheck A may cover half the rent, half the utilities, groceries, gas, and sinking funds.

- The second paycheck could cover half the rent and insurance and half the phone and internet, groceries and the debt snowball.

The aim is to equalise the burden so that neither payment feels overwhelming. If one check includes rent plus too many high expenses, move a couple of those items over to the other check and use the bill buffer to cover transmission gaps.

Step 4: Sinking Funds Help Cover Expenses that Occur Infrequently

The “true expenses” that everyone seems to forget about (everman do this), or which are non-monthly bills are, your car tags, yearly subscriptions, xmas decor, back-to-school, car repairs, etc. Instead of panicking when they show up, pre-save biweekly.

- Car maintenance (goal $600/year) → $23 per paycheck.

- Holiday gifts (goal $800/year) → $31 per paycheck.

I'm not sure what you want, can you please clarify?

Put your sinking funds in a different savings account and name them in your bank app. That name is a promise to yourself.

Step 5: Implement Automation for Boring Tasks

Automation keeps your plan consistent.

- Set up automatic payments for each bill on every debt so you never miss a due date.

- On payday, auto-transfers send money from allocation for bills for the bills account and allocation for sinking funds for the savings.

- To keep your credit score healthy, make small mid-cycle payments on your highest utilization card to calm your reported balance.

- Create reminders for 3-5 days before the payment date and on your statement cut on credit cards. Timing = fewer surprises.

Step 6: Utilize 3-paycheck months to your advantage.

Twice a year, you’ll get a month with three paychecks. Don’t treat it like free-spend season. Decide now where those checks go.

- If you’re starting, aim to set aside your first $1,000 or one full month of expenses as you progress.

- Attack the balance with the highest Debt interest.

- Annual bills top-off (insurance, tuition, summer camps).

- Major sinking goal (car tires, home projects, dental).

Add it to your calendar with a note “3rd paycheck → emergency + debt”, and thank yourself for doing it in advance for the future!

Step 7: Try the First Month And Make The Necessary Changes

People should start utilizing the term “ Budgeting ” as it’s a living system not a one-off spreadsheet. After your first month.

- Did groceries explode? Increase the category by $10-20 per paycheck and rob from a lesser category.

- Did gas come in under? Shave $10 and move it to debt snowball.

- Were you short on a due date? Add $5 to that bill’s biweekly contribution.

- Small edits compound into a rock-solid plan.

A Simple Biweekly Paycheck Budget Template (Example) 📋.

Here is the paraphrased version of the given text (27 words):

The simplified budget uses net pay per check of $1800 plus rent of $1600, utilities of $220, internet/phone of $140 and a car payment of $350.

| Category | Paycheck A | Paycheck B |

|---|---|---|

| Rent (half) | $800 | $800 |

| Utilities (half) | $110 | $110 |

| Internet + Phone (half) | $70 | $70 |

| Car Payment (full) | $350 | — |

| Insurance (half) | $60 | $60 |

| Groceries | $180 | $220 |

| Gas | $80 | $80 |

| Sinking Funds | $75 | $75 |

| Debt Minimums | $75 | $75 |

| Leftover to Goals | $— | $310 |

Notes:

- We loaded the car payment on Paycheck A so groceries are a little higher on Paycheck B to keep it real.

- The extra money you have left over at the end of B, becomes your snowball, or emergency fund contribution. If A seems tight, decrease the amount in B by a small bill, or increase A’s leftover amount by decreasing some categories.

Three Real-World Profiles (So You Can Copy-Paste) 👥.

Renter, One Income, Modest Debt

- Rent split must be public: $800 + $800.

- Push debt snowball on Paycheck B.

- Use your 3 check months for emergency cushion first 1000 then rest of the debt.

Couple, One Salary + One Side Hustle

- Use your salary checks to live on; use your side hustle deposit like a bonus for your debt and sinking funds.

- Include a Hustle Tax/Quarterly sinking fund to avoid surprises in April.

- Smooth utilities with round-up contributions.

Single, Car-Heavy Suburb

- Increase gas per paycheck.

- Create a tires/brakes sinking fund and automate it.

- Micropay credit card mid-cycle, keep credit utilization low.

Groceries & Everyday Spending Without the Drama 🥬.

Biweekly budgets collapse if everyday spending is wild. Try this two-envelope approach (digital or physical).

- Groceries Envelope (per paycheck).

- Everything-Else Envelope (per paycheck).

Refill on payday, not mid-week. Whenever “Everything-Else” runs dry, only borrow from your next check if you trim something else now. Behavior > intention.

Buffet Strategy: Two Layers of Calm

- Bill Buffer (inside checking): those small round ups you parked for fixed bills. It handles rate drift and small timing errors.

- Having one full paycheck in checking at all times. That’s your noise-cancelling headphone for cash flow.

Use a 3-paycheck month to elevate a micro-cushion of $200–$300 to a full paycheck.

How to correctly handle irregular items that come up

List every non-monthly bill with the due month.

- Car insurance (semi-annual).

- Life/disability insurance (annual).

- Tags/registration (annual).

- Holiday gifts (Q4).

- Back-to-school (late summer).

Split each by 26, contribute every pay period, and refer to fund by its purpose. When the bill comes, you hit transfer—not a panic or credit card spiral.

Debt Paydown Inside a Biweekly Plan 🔧

- Minimums on autopay (protect your score and sanity).

- The largest of your two paychecks (often B) has the snowball, a biweekly extra payment, to the highest-interest balance.

- In a month when you get 3 paychecks, just pay one full extra toward the same balance. Momentum is everything.

Tips, Tricks, Hacks & Local Secrets 🧠

- Keep the reported balance of your credit card lower by paying it 3-5 days before the statement cuts.

- When a bill is contributed, it is round-up between $2 and $5. The bill buffer will be reviewed quarterly and any surplus will be redirected toward paying down a debt.

- You can add Calendar labels to your checkbook like Paycheck A and Paycheck B with bullet lists of what the paycheck pays for. You’ll never wonder, “What was this check for again?”.

- If the week’s groceries are not very different, we will split the grocery in a 60/40 manner across A/B so that the week that has more family meals gets the bigger pot.

- Review your subscription audit quarterly and remove your two least active subscriptions. Replace them with sinking funds.

- Mid-cycle, stop sending $20 – $50 to your highest-balance card. Tiny moves shape the trend that models read.

- Cashback Discipline: Don’t treat cashback as income. Think of it as a discount coupon. Keep your spending in line with your plan.

- Not all bills can fit into the current structure. To avoid misalignment with existing bills, sleep on the upgrade before you spend on the upgrade. If it doesn’t, cut something or wait.

- Keep most of your accounts at a zero balance but a credit card at a 10% balance. It’s a tidy utilization habit for calmer scores.

- Little Luxuries Line: Set aside a little “fun money” every payday. Saying no forever backfires.

Troubleshooting (When Life Throws Elbows) 🧯.

- My first paycheck is too tight.

Move a smaller bill from A to B. Raise A's grocery expenses by $15 and lower B's discretionary expenses by $15.

- I keep overdrafting between due dates.

Stop paying bills the moment they arrive. Pay them from the bill account on autopay, funded biweekly.

- Utilities swing wildly in winter/summer.

A seasonal cushion of $10 per pay period can be added in October through March for heat and May through August for air conditioning. Review quarterly.

- My income is partly variable.

Use the salary to cover fixed A/B templates. Use variable earnings for specific goals only.

- I forgot an annual bill—again.

Add it to the sinking fund list today. Divide by 26. Automate.

- I hate spreadsheets.

Use any budgeting app with pay-cycle scheduling. Your method > your software.

FAQs

What is a biweekly budget?

How many paychecks per year is biweekly?

Should I split rent/mortgage across both checks?

What do I do in 3-paycheck months?

How do I handle annual bills?

What if a bill is due before I get paid?

How much should groceries be per paycheck?

How big should my checking cushion be?

Is cash stuffing necessary?

Should I automate everything?

Can I still use credit cards?

How do I stop impulse buys?

What’s the fastest way to feel progress?

Is zero-based budgeting required?

What if my partner’s paid on a different schedule?

How can I reduce bill stress quickly?

Do I need separate bank accounts?

How do I budget irregular income only?

Can I start in the middle of the month?

What if my rent is due on the 1st but payday is the 5th?

Final Thoughts 🌤️

A biweekly budgeting system is merely a repeatable checklist for each paycheck. Breakdown your paydays, don’t forget the big bills, take care of boring stuff automatically, and have buffers and sinking funds.

Keep it straightforward. Keep a steady pace. The 3-paycheck months will take care of it. When money is pointless, life is light.

Comments (0)

No comments yet. Be the first to share your thoughts!

Leave a Comment