For instance, let’s say you wake up at 42, 47, maybe 53. And your retirement accounts are something of a side quest. You have actual costs, real obligations, and genuine time constraints. Would you prefer to invest with a target-date fund or a low-cost fund mix that you can fine-tune yourself?

This manual explains it in layman's terms for those late starters (40+) We’re going to look at costs, risk, glide paths, taxes, rebalancing and, most important of all, how easy it is to stick with the plan when life makes noise. No scare tactics. No jargon you don’t need. Just a clear path you can follow starting this weekend.

The Core Idea (Without the Jargon) 🧭

You choose a few broad, low-cost index funds (e.g., total US stock, total international, total bond). You have the ability to choose your stock bond split, rebalancing, and tax placement.

TDFs are a type of mutual fund, which is quite popular. It does the rebalancing for you. It will also add bonds each year as needed.

If you want maximum simplicity, TDFs are hard to beat. If you want precise control of your retirement savings or your 401(k) TDF is pricey, a DIY index mix may bring lower fees and match risks to your reality.

What Late Starters Need Most 🧑🦳→💪

- A contribution plan you can stick with (auto-contribute every paycheck).

- A risk level you won’t abandon during volatility.

- Costs low enough to keep more of your returns.

- Fewer moving parts (unless you truly enjoy tinkering).

- Planning for payments that will be credited following a month-end date.

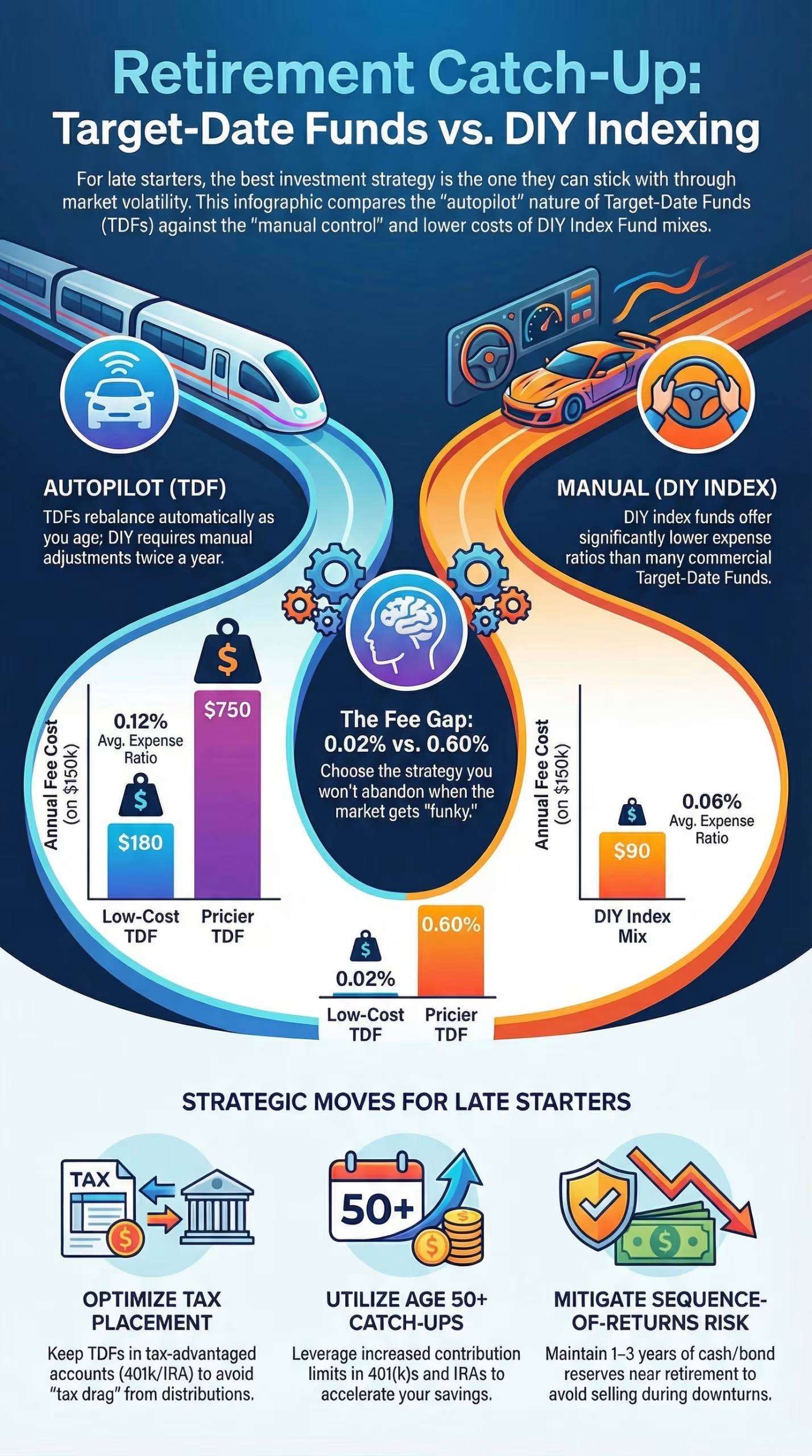

Fees & “Invisible” Costs (Where Money Quietly Leaks) 💸

Typical expense ratios (ballpark).

- Broad index funds: ~0.02%–0.15%.

- Target-Date Funds Cost Range: 0.08% to 0.60%

With a balance of $200,000, a yearly difference of 0.40% means $800 every year before the growth of the investment. In ten years or twenty, that’s a highway you never drive, a kitchen you never renovate, a retirement cushion you never sit on. Look at your fund’s TDF expense ratio. Some are awesome and cheap; others… not so much.

Glide Path versus Manual Control

The fund automatically adds bonds and reduces equity as you age through a glide path. Some people smoothly enter retirement and cease working, while others transition into retirement yet keep slowing down for many years.

You choose your index mix with a DIY format. Select the stock/bond split that appeals to you for instance, 70/30. The funds will then rebalance once or twice a year. If you don’t mind experiencing ups and downs, you can own more stocks. Alternatively, if a sequence-of-returns risk gives you insomnia, you can add a few bonds.

The ideal glide path is one that you’ll stick with even when markets get funky. If autopilot helps you stay invested, TDFs are a gift. If you want more refined control (say, stronger bond floor at 55), it’s DIY.

Taxes & Account Placement (Where to Put What) 🧾

A 401(k) or IRA is a perfect home for bonds and tdfs and provides a tax-advantaged shelter for their distributions every year.

Taxable brokerage accounts are best for tax-efficient index funds (broad stock indexes tend to be tax-friendly).

TDF kink: In taxable accounts, TDFs can distribute more taxable income than a simple stock index—so many late starters keep TDFs inside retirement accounts and stock index funds in taxable. Using one-fund everywhere is fine just understand the trade-off.

Rebalancing: Autopilot vs. Adulting 🔁

- TDFs: Rebalance for you. No spreadsheets, no second-guessing.

- You want either a calendar rule, e.g., every June & December, or a band rule, i.e., rebalancing if a holding drifts ±5%.

In case ‘I’ll rebalance later’ really means ‘I’ll never rebalance,’ TDFs are worth their weight in sanity.

How Much Risk for a Late Starter? (Realistic Ranges) 📊

There is no the same for all but let’s see how many late starters think about it.

- A 70% stock and 30% bond allocation, or a more conservative 60/40 mix, fulfills the wish for a healthy growth of funds.

- From the ages 50 to 59, 60-40 or 50-50 can improve sleep and catch-up contributions are available.

- If retirement is in about five years and withdrawals are near, 50-50 or 40-60.

Again, behavior beats precision. Choose the mix you’ll actually keep through storms.

Sample Blueprints You Can Copy (and Own) 🧱

One-Fund Simplicity (TDF in a Tax-Advantaged Account) 🧺

- Choose a 100% Target-Date Fund that correspond with the year you wish to retire around. Alternatively, select according to risk, not age—see hacks below.

- Auto-contribute each paycheck.

- Done.

Two-Fund Index Core (DIY, Very Low Cost) 🧯

- Total US stock index.

- Total US bond index.

- You can add 10–30% of Total International Stock if desired.

- Rebalance twice a year or at ±5% drift.

Three-Fund Classic (Diversified DIY) 🌍

- US Total Stock + International Total Stock + US Total Bond.

- Choose the stock to bond ratio and rebalance on a schedule.

Cost Breakdown Example (Reality Check) 🧮

| Portfolio | Expense Ratio (example) | Balance | Annual Fee Drag |

|---|---|---|---|

| DIY index mix | 0.06% | $150,000 | $90 |

| Low-cost TDF | 0.12% | $150,000 | $180 |

| Pricier TDF | 0.50% | $150,000 | $750 |

If your company plan has only an expensive targeted fund, check to see if a do-it-yourself index mix is available. If not, keep the fund, to keep things simple, and raise your savings rate to make up the difference. Behavior > theory.

Catch-Up Contributions & “Late Starter” Cash Moves 🧩

- Use the extra allowed contributions in your 401(k)/IRA at age 50+.

- During 3-paycheck months, consider the third paycheck for retirement and debt improvement.

- If you are eligible, think of HSA as a ninja account that helps you to save for your health costs in retirement.

- Eliminate high-interest debt since it gives you a low return.

Sequence-of-Returns Risk (The Sneaky One) ⚠️

Withdrawing money just before or after retirement, when the market is down, can lead to losses. Late starters can dial this down by.

- Before retirement, one must hold a bond/short-term reserve equal to 1-3 years of withdrawals.

- Reducing withdrawal rate in bad years.

- Go for a TDF with a slow glide path if you want autopilot.

When a TDF Is a Slam Dunk (and When It’s Not) 🏀

Great fit if you

- Want one fund, forever.

- Struggle to rebalance or second-guess yourself.

- Have access to a low-cost TDF in your plan.

Maybe not if you

- Have a taxable account and want max tax efficiency.

- Do you want to impose tighter controls on the bond floor after you cross 55? Are you stuck with a high-fee TDF but have cheaper index options?

Choosing Based on Age and Picking by Risk

The TDF year that corresponds to your birth date isn’t obligatory. Two practical tweaks.

- More conservative? Choose a later retirement year (the glide path will be more conservative sooner if the provider designs that way) or choose “retirement income” version.

- More aggressive? Choose a past year (path remains stock-heavy for long).

Make sure to look at the glide path chart of the fund so that it is in accordance with your way of dialing the risk.

Automate Contributions (and Rebalancing) Like a Pro ⚙️

- Auto-contribute every paycheck.

- If you do it yourself, set calendar prompts to rebalance your investments twice per year or use rebalancing bands.

- Enhance contributions as salary increases (pay yourself first increase).

- Always keep extra cash equal to one month’s expenses as buffer so that you never have to sabotage contributions to fix bill emergency.

Multi-Account Reality (401(k), IRA, Taxable) 🧳

- A target-date fund in your 401(k) and a stock index fund in the taxable account can be a clean combination.

- If you hold bonds in taxable, understand the tax drag.

- If your plan rules allow, roll your old 401(k) into your current plan or an IRA if the options and fees are better.

Decision Guide (Choose in 60 Seconds) 🧠➡️✅

- I want simple and I’ll actually stick with it. → Low-cost TDF in 401(k)/IRA.

- My plan’s TDF is pricey; I don’t mind 3 funds. Go for a DIY index if you need more diversification.

- I’m nervous about risk but behind on savings. Try to get your retirement with TDF “through” next births, or DIY with 50–60% stock floor; raise savings rate.

- I like control and tax efficiency. Create index, bonds in tax-advantaged, broad stock index in taxed.

Tips, Tricks, Hacks & Local Secrets 🧠

- Raise savings in tiny bumps. Step it up 1% over the next quarter; you barely notice it; but your future self does.

- Stop chasing star funds. Low fees + broad exposure wins most boring years.

- Avoid combining TDF with additional stock funds in one account – it disrupts the glide path.

- Bond floor = sleep floor. If you find the news unsettling, just add more bonds and lock it in.

- Name your accounts by purpose. You will take them more seriously, e.g., ‘Retire-60’, ‘Bridge-5yrs’, etc.

- Follow paycheck guidelines. The dedication to savings starts before the money enters the checking account. Out of sight, out of temptation.

- Keep one boring default. When you're stuck overthinking it, TDF prevents you from obsessively changing it up.

- Check plan fees annually. Re-evaluate TDF versus DIY if employer changes providers.

- Don’t time the market. Time in the market beats most clever timing schemes.

- Write a 1-paragraph IPS. Keep it simple with your IPS: what you want your stock v bond split to be, when you will rebalance, and when you’ll consider changing it (job change, major life event).

FAQs

Are target-date funds good for late starters?

Are index funds cheaper?

Which has better returns?

Can I hold a TDF in taxable?

What if my plan’s TDF is expensive?

Should I pick a TDF by my birth year?

Can I combine a TDF with extra funds?

Is 60/40 still a thing for 50-somethings?

How often do I rebalance an index mix?

What about international stocks?

Should I wait for a dip to start?

How big should my emergency fund be?

What if I start at 55?

Can I switch TDF providers later?

Are bonds “safe”?

What’s the withdrawal plan later?

Do HSAs matter for retirement?

Should I consolidate accounts?

How do I choose a bond fund?

What if my partner wants TDF and I want DIY?

Is this financial advice?

Final Thoughts ❤️

You don’t need a perfect plan—you need a repeatable one. If the target-date fund makes you consistent, that’s a win. If a low-fee index mix pushes your buttons and lets you sleep easy, that’s a win, too. Choose the path that is right for you, automate contributions and let time do its thing. Starting late means starting smart—and sticking with it.

Comments (0)

No comments yet. Be the first to share your thoughts!

Leave a Comment