Picture this: You use your credit card to buy in two places on the same week. One score says you’re solid. The other? Sketchy. What does that mean—and what should you do about it?

In this guide, we’ll break it down in plain English: how FICO 10T and VantageScore 4.0 actually view your credit behavior, why they can swing apart, and the moves that help you look good to both. Forget fluff—this is about approvals, rates, and your next big “yes.”

The Real Difference (Without the Jargon) ✂️

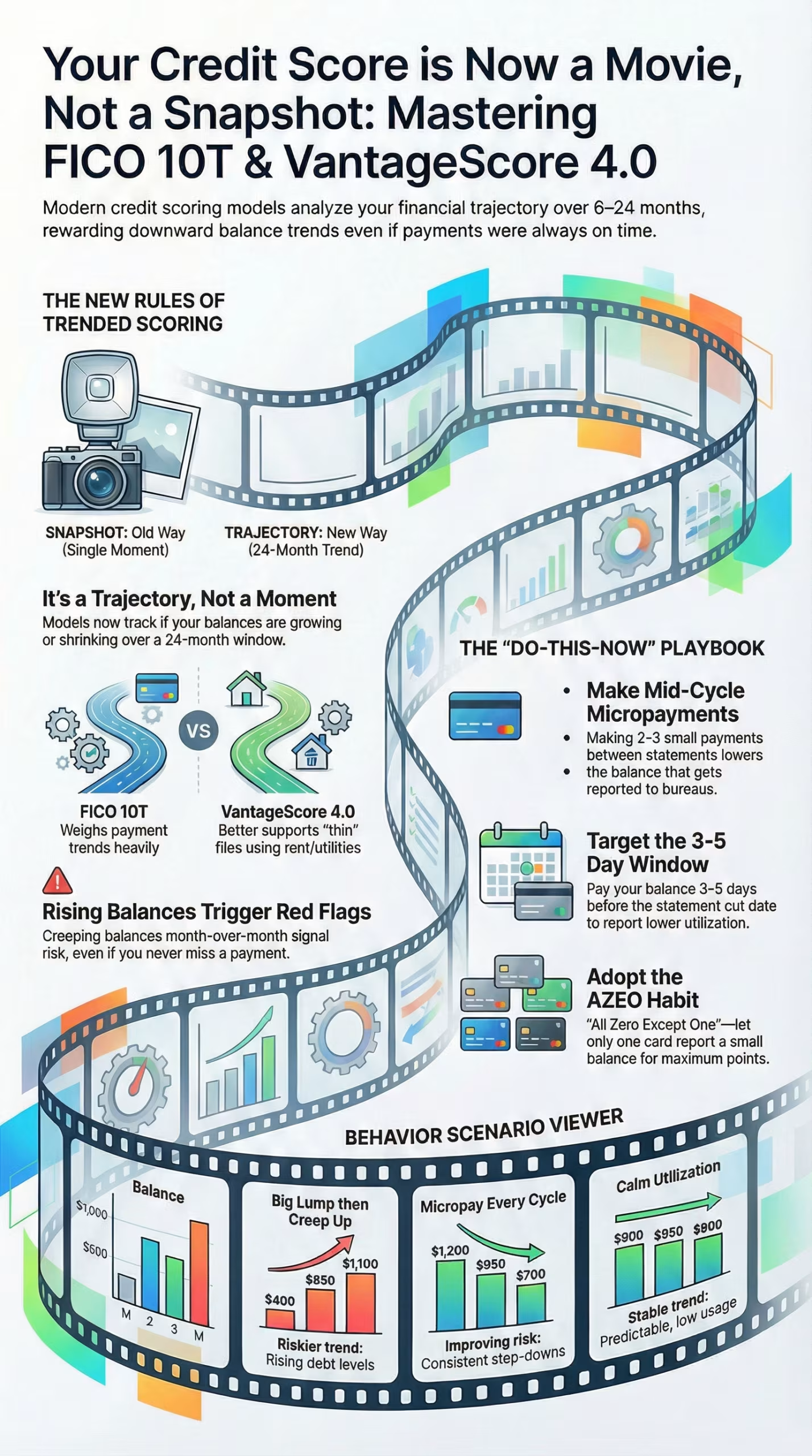

- FICO 10T weighs your trended behavior—how balances and payments move over time. Falling balances and payments above the minimum = good signal. Creeping balances month after month = risk signal.

- VantageScore 4.0 also reads trends and is more likely to score thinner/newer files if there’s recent activity. It can incorporate alternative positives (e.g., properly reported on-time rent or utilities).

- Bottom line: On-time payments and sensible utilization help on both. Rising statement balances—even with no late pays—can still hurt because the trend looks riskier.

How Your Day-to-Day Behavior Shows Up

Balance Behavior = The New Big Deal

- Downward trend: Balances steadily shrinking month to month = strong signal.

- Flat trend: Steady usage + steady payments = fine, but no bonus points.

- Upward trend: Balances rising across several cycles = red flag (even if on time).

- Micropayments help: 2–3 small payments between statements can lower the number that gets reported.

Thin Files & Fresh Starts

- New to credit? VantageScore 4.0 may generate sooner with recent activity; FICO often wants more history.

- Rebuilding play: 1 low-fee (or secured) card + 1 positive tradeline that reports like clockwork (e.g., verified rent reporting).

- Keep usage calm: Low utilization beats zero-use dormancy.

Alternative Signals (When Properly Reported)

On-time rent, utilities, or phone bills can supplement thin files if they’re accurately reported. They add to, but don’t replace, solid credit card habits.

Buy Now, Pay Later (BNPL)

- Treat it like a loan: one at a time, autopay on, no stacking multiple plans.

- Predictable patterns > impulse swipes. Messy trend = messy score.

Who “Wins” Under Each Model?

If You’re a “Transactor” (pays in full)

- Keep statement balances low on reporting day (pay 3–5 days before it cuts).

- AZEO habit: let one card report a small balance occasionally; others report $0.

If You’re a “Revolver” (carries balances)

- Your trend matters more—use mid-cycle micropayments to bend it downward.

- Only do balance transfers if total cost is lower and you can clear it in promo period.

If You’re “Thin File” or Rebuilding

- Add one main card (secured if needed) + a reliable positive reporter (e.g., rent).

- Keep utilization low and payments boringly on time.

If You’ve Consolidated Debt

- Don’t re-load old cards. Set calendar reminders to pay 3–5 days pre-statement.

- Steady shrink > one-time splash. Lenders read the last 6–24 months, not one big month.

What Actually Changes for Approvals & Rates

Lenders care more about your recent trend than a single great month. Some use newer models, some older—either way, the winning pattern is the same: on-time payments, calm utilization, and a visible glide-path down on balances.

The “Do-This-Now” Playbook ✅

- Autopay the minimum on every account to avoid a single late mark.

- Add a micropayment mid-cycle on any card with heavy spend.

- Pay 3–5 days before statement cut so a smaller balance gets reported.

- Don’t close your oldest card; ask for a product change if the fee bites.

- One new account at a time; space applications to keep the trend clean.

- Legit rent reporting can help thin files (make sure it’s accurate and ongoing).

- BNPL discipline: one at a time, autopay on, predictable usage.

| Scenario | Month 1 | Month 2 | Month 3 | What the Models See |

|---|---|---|---|---|

| Big Lump, Then Creep Up | $1,500 → $400 | $400 → $850 | $850 → $1,100 | Brief dip, then rising balances = riskier trend |

| Micropay Every Cycle | $1,500 → $1,200 | $1,200 → $950 | $950 → $700 | Consistent step-downs = improving risk |

| Calm Utilization Routine | $900 on $9k limit | $850 on $9k | $800 on $9k | Low, steady use = stable, predictable |

Takeaway: Your pattern matters more than one heroic payment.

Pro Tips, Tricks & Local Secrets 💡

- Time larger payments mid-month to lower what gets reported.

- Split subscriptions (Card A) and groceries (Card B). Mid-cycle, pay down whichever has higher utilization.

- Write down each card’s statement date in your banking app; pay before those dates.

- Grace period guardrail: pay in full by due date to avoid interest even if a balance reported mid-month.

- Points aren’t worth it if balances climb. Keep utilization quiet; limits aren’t a spending target.

FAQs (Quick, Clear, No-Nonsense)

Does one model run higher than the other?

Why is my score different across apps?

Can I choose which model a lender uses?

Do small mid-cycle payments help?

What’s “utilization”?

Does paying before statement close hurt me?

If I pay in full, why did my score dip?

Is BNPL safe for my score?

Can rent help my score?

How long until good habits show up?

Is it worth asking for a credit limit increase (CLI)?

Does paying twice a month matter?

Fastest “look better” move right now?

Final Thoughts ❤️

Different scoring models come to different conclusions about your credit history. Don’t stress about it. The smartest move isn’t chasing a certain number. It’s making sure your balances are nice and calm and trending down, which done with paying on time and letting a few simple automations do the hard work.

If you do this, you will look good under FICO 10T and VantageScore 4.0 and, most important of all, you will get more yeses when it matters.

Comments (0)

No comments yet. Be the first to share your thoughts!

Leave a Comment